About 1031 Exchanges

Like-kind exchanges — when you exchange real property used for business or held as an investment solely for other business or investment property that is the same type or “like-kind.”

That’s the IRS definition. 1031’s have been around for a long time. Properties are of like-kind if they’re of the same nature or character, even if they differ in grade or quality.

Why a 1031?

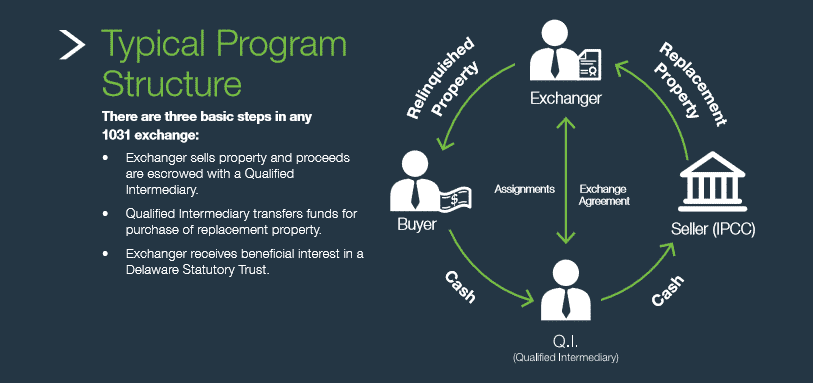

The reasons to participate in a 1031 exchange are numerous. There are specific timelines and procedures that must be followed to take advantage of the benefits of this program.

- Seller should have the contract specify that the sale may be structured as a 1031 exchange.

- Seller cannot receive or control the net sale proceeds – the proceeds must be deposited in a qualified escrow.

- Replacement property must be like-kind to the relinquished property.

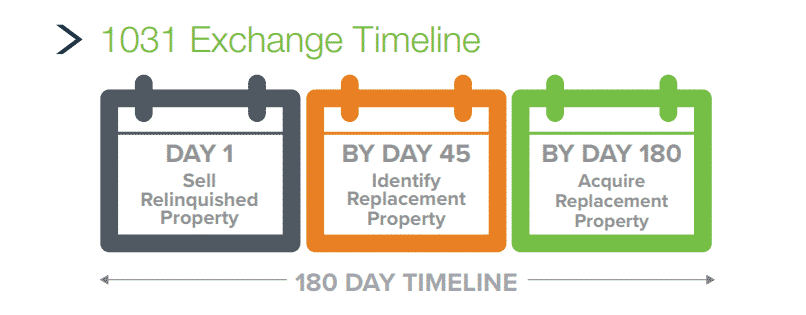

- The replacement property must be identified within 45 days from the sale of the original property.

- The replacement property must be acquired within 180 days from the sale of the original property.

- In a reverse exchange the taxpayer acquires the replacement property prior to disposing of the relinquished property.

- Generally, the cash invested in the replacement property must be equal to or greater than the cash received from the sale of the relinquished property.

- The debt placed or assumed on the replacement property must be equal to or greater than the debt relieved with regard to the relinquished property.

Advisory services offered through FRS Advisors, a Florida registered investment advisor.